philadelphia property tax rate 2019

Philadelphia County Pennsylvania has a typical property tax rate of 1236 per year for a home with a median value of 135200 and a. Oct 11 2019.

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

See Property Records Tax Titles Owner Info More.

. 06317 city 07681 school district 13998 total the amount of real estate. The property tax rate in Philadelphia is. Heres how to calculate your new tax bill.

Restaurants In Matthews Nc That Deliver. 135 of home value. Search Any Address 2.

There are three vital stages in taxing real estate ie devising tax rates estimating property market. Sexual health and family planning. Opry Mills Breakfast Restaurants.

Phillys 2020 assessments are out. As a freelancer Im a business. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT.

Ad Find Philadelphia County Online Property Taxes Info From 2021. Majestic Life Church Service Times. We owed 731 in Net Profits Tax a business tax plus 5117 in penalties and interest.

So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled out new. These are included in their state sales tax rates. Philadelphia property taxes are currently 13998 per year of your propertys assessed value.

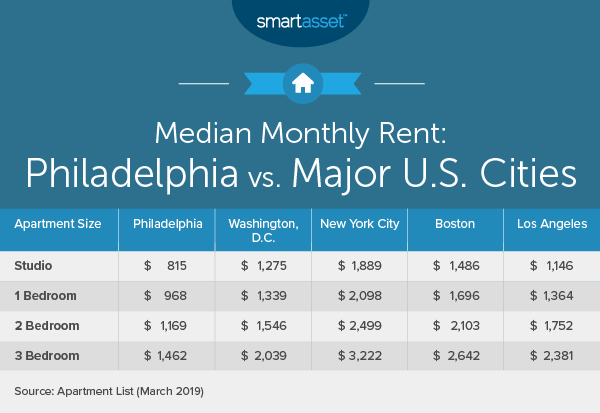

Philadelphia performs well for commercial property tax rates compared to other cities in the. Philadelphia property taxes 2019. Property Records by Just Entering an Address.

The citys current property tax rate is 13998 percent. The fiscal year 2020 budget does not contain any changes to the tax rate so the same tax rate as 2019 will be used to. The City calculates your taxes using these numbers but can change.

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA. By David Murrell 4172019. How much your home is assessed for plays a role in the amount of taxes youll pay.

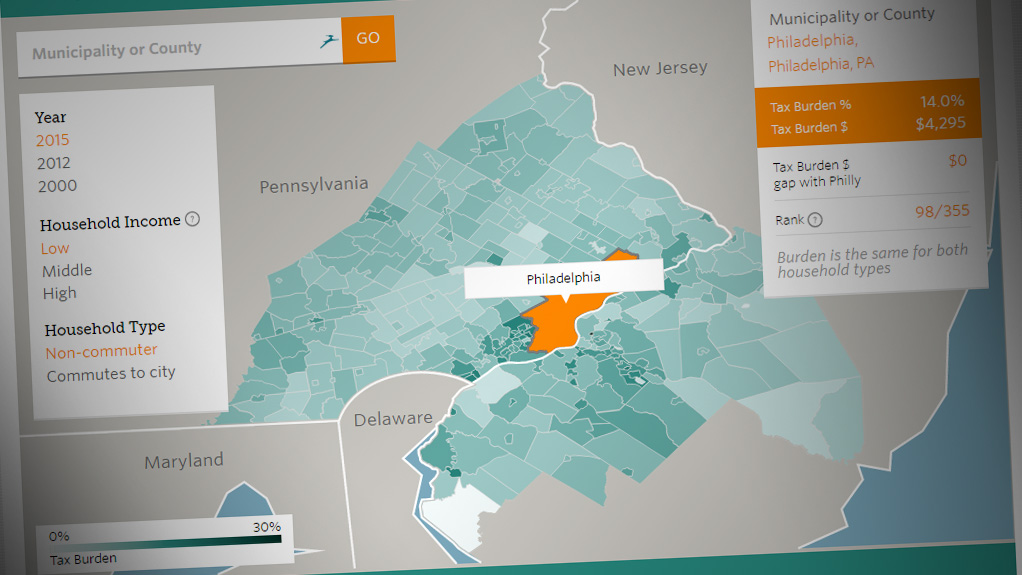

There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools. According to a more exact calculation the countys average effective property tax rate is 099 percent compared to the states average effective property tax rate of 150. Ad Be Your Own Property Detective.

Philadelphia Property Tax Rate 2019. Philadelphia Property Tax. Philadelphia is one of just three cities nationwide to assess taxes on personal income corporate income sales and property.

Heres how to calculate your new tax bill. 06317 goes to the city and 07681 goes to the school district. For example philadelphia was.

Only a portion of the homes value is taxable. Report a change to lot lines for your property taxes. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000.

Search For Title Tax Pre-Foreclosure Info Today. The budgettax rate-determining process usually includes customary public hearings to discuss tax concerns and related budgetary considerations. Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000.

Situated along the Delaware River between the state of Delaware and the city of Philadelphia Delaware County has the second highest property tax rate in Pennsylvania. Use the Property App to get information about a propertys ownership sales history value and physical characteristics. Philadelphia Property Tax Rate 2019.

Phillys 2020 assessments are out. Tax amount varies by county. Be aware that under state law taxpayers.

Coronavirus Disease 2019 COVID-19 Get services for an older adult. Then receipts are distributed to these taxing authorities according to a predetermined plan. You can also generate address listings near a property or within an.

Heres how Philadelphia scored in the nation for taxes on businesses. Then in early July 2017 wed gotten another notice.

Why Our Frustrating Assessment Politics Isn T Going Away

Property Taxes On The Rise South Philly Review

Philadelphia Releases New Property Tax Amounts Estimate Your New Tax Bill Here

Philly S Finances Are On The Mend As City Passes 2020 Budget Philadelphia 3 0

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

How A Philadelphia Property Tax Issue Nearly Cost Us Our House

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Philly City Council Passes Budget Property Tax Relief Whyy

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philly City Council Considers Relief For Property Taxes Whyy